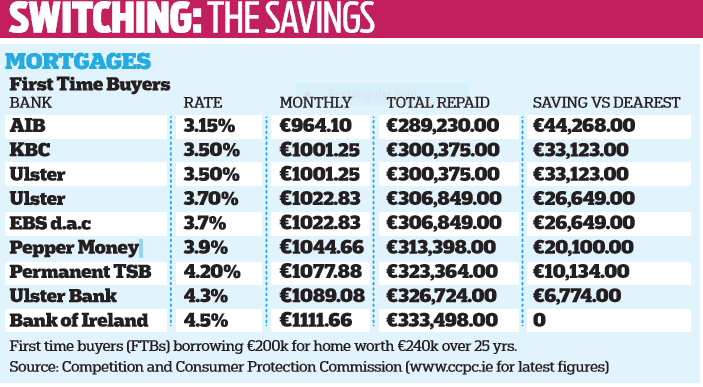

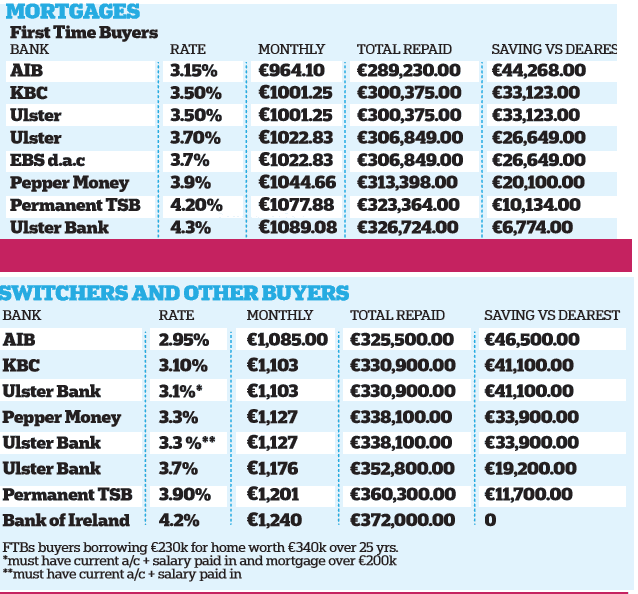

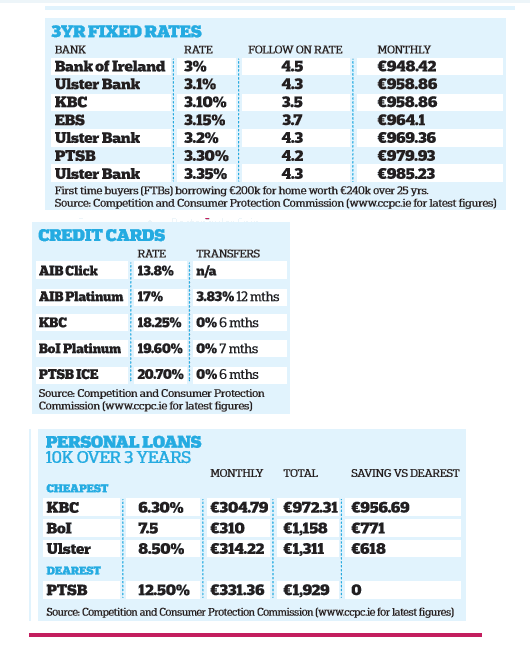

ALMOST everything else pales into insignificance. If you do nothing else about our other 100 tips — in fact if you do nothing else in life — do this. People often moan about bank charges. They differ by about €48 a year, one survey found. Switching your mortgage would save an average borrower up to €46,500 (see table, below right). Check how much you’re paying for your mortgage and move somewhere else if it’s less than the cheapest. With this kind of savings, it’s worth switching.

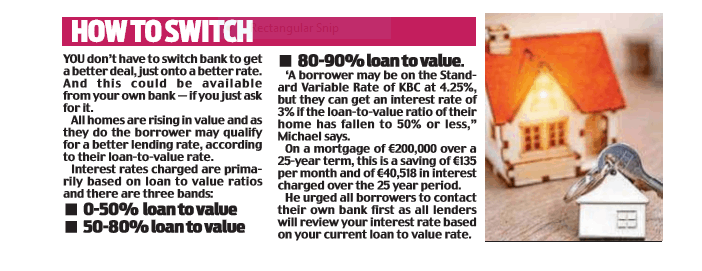

Lets say you’re a switcher with a decent chunk of mortgage repaid and you’re on KBC’s 3.1% rate. You’d probably glance at the table we’ve included and give yourself a pat on the back. Sm art cookie. And you’d deserve it. But even on this low rate, you could still save €5,400 by moving just a smidgeon lower to AIB’s 2.95%. If you’re on an expensive m ort gage rat e with a high loan amount, the savings you can make are vast — between €40,000 a n d €100,000 by moving your mortgage to a cheaper loan rate, according to one broker.

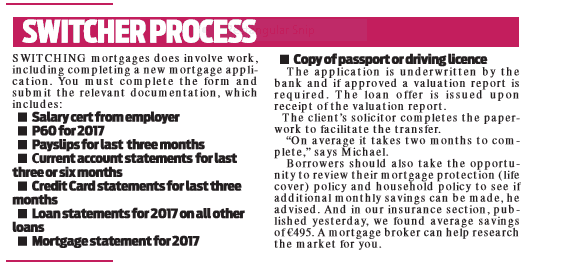

Most borrowers are unaware of the huge potential savings, said Joey Sheahan, head of credit, MyMortgages.ie. ‘As many of two in five mortgage holders should be switching to another lender yet switching made up just 3.3% of the mortgage market in 2014. ‘While this figure has certainly increased since then, it is nowhere near where it should be. ‘So

what are you waiting for? Get switching! Mr Sheahan gave an example of one happy couple who stand to save €99,000 from switching their €390,000 homeloan from a rate of 4% to one of 2.6%. They could opt to take the money, or reduce their mortgage by six years, he said.

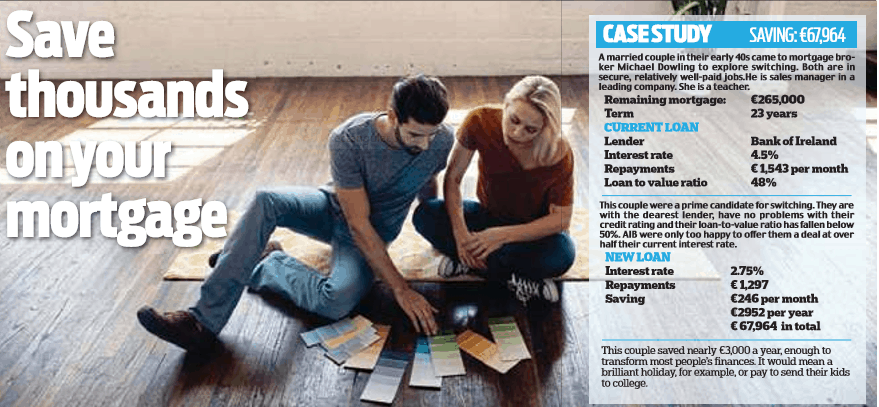

Between January and September last year, there were €472m worth of switcher mortgages completed. That sounds like a lot, but out of a total market of €5bn, it’s not. ‘Switcher mortgages accounted for 9% market share for this period. In other words, 91% opted to stay put despite being on a relatively high mortgage rate, as most borrowers are,’ said mortgage broker Michael Dowling of Dowling Financial in Dublin 3.

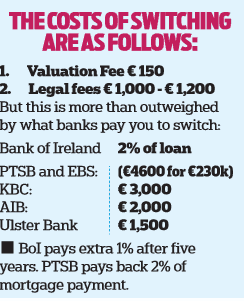

“All banks are chasing switcher clients and the costs of switching are paid by all lenders.” As you can see, you could make a handsome profit on the incentives, which can be treble the costs of switching. So there is absolutely no excuse. But be warned, as we advised earlier, the dearer lenders pay the most goodies for switching to lure you into a pricey variable rate.

Source: Daily Mail Ireland 25 Feb 2018

If you are interested in switcher mortgages and would like to speak to us at MyMortgages.ie please don’t hesitate to contact us at [email protected] in Cork +353 21 4277037 or 353 86 8060601

MyMortgages Ltd t/a MyMortgages.ie is regulated by the Central Bank of Ireland.